1.1 KaoyaSwap project introduction and structure

Introduction

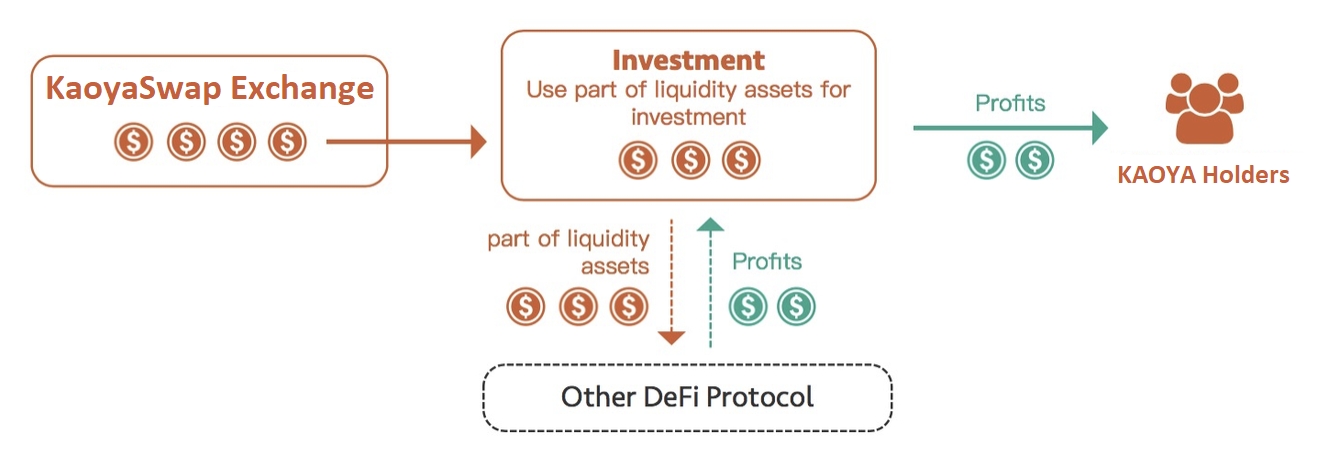

KaoyaSwap is a bsc-chain deployed decentralized transaction protocol built upon AMM and exchange pools. It has an embedded investment platform that aims to increase the income of liquidity providers. It is deployed on the Binance Smart Chain. KaoyaSwap utilizes funds in the platform's liquidity pool to execute automatic trading strategies. In addition to the fee incomes similar to other decentralized exchanges, users of KaoyaSwap also receive considerable investment earnings. You can think KaoyaSwap as a spot forex exchange, and it saves part of the deposited funds in a bank to earn interest.

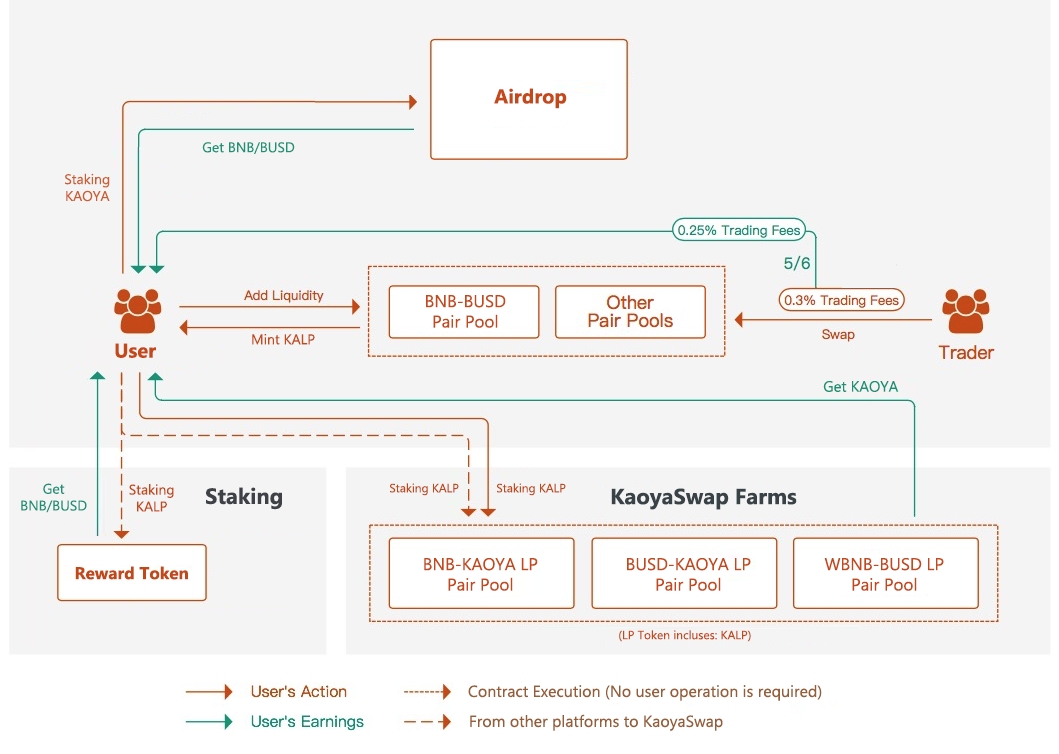

KAOYA is the token on the KaoyaSwap platform, which is distributed 100% through liquidity mining, without any pre-sale, pre-mining, and team shares. Holders of KAOYA token are able to participate in platform governance and receive KaoyaSwap dividends through Farming and Staking. Platform income now includes transaction fees, income from liquidity investment, and service fees from Vaults, with more sources of income under development.

Core components

Core components

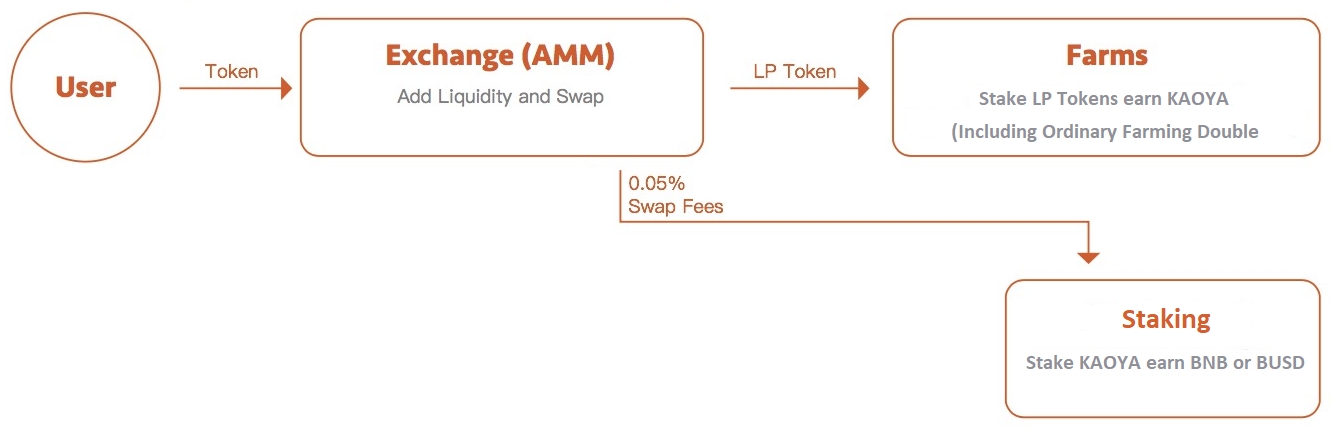

KaoyaSwap Exchange: a decentralized trading platform using AMM transactions (part of the funds are invested by Investment)

KaoyaSwap Farms: a liquidity mining platform used for liquidity incentives, supporting ordinary mining and double mining

KaoyaSwap Staking: Users can obtain BNB and BUSD income by staking KAOYA (including 25% income from Investment, 0.05% fee income of Swap (not realized yet))

KaoyaSwap Airdrop: Users can obtain BNB and BUSD income by staking KAOYA (including 25% income from Investment, 0.05% fee income of Swap (not realized yet))

Component architecture and collaboration

KaoyaSwap builds a complete DeFi integrated platform through the interaction between multiple components. Users can play the roles of traders, liquidity providers, investors, etc. in the KaoyaSwap ecosystem.

Project Features

High asset utilization and high yield. It is able to use funds in the platform's liquidity pool for automated strategic investment

A fairer token distribution mechanism encourages community members to actively participate in governance

Vaults will use decentralized exchange funds for financial management through contracts to offer users high returns

Comprehensive on-chain governance, decentralized control and development from the start

Last updated